MobiKwik ZIP is a Buy Now, Pay Later (BNPL) service offered by the Indian digital wallet platform MobiKwik. Like Freecharge Pay Later, it allows users to make purchases on MobiKwik and partner retailers and pay for them later. If you are wondering how to close MobiKwik Zip or deactivate MobiKwik Zip Pay Later service, this guide will walk you through the steps.

Table of Contents

MobiKwik Zip Pros & Cons

MobiKwik Zip comes with several benefits, making it a useful tool for managing your finances. Some of MobiKwik Zip pros are:

- Enhanced Purchasing Power: With MobiKwik Zip, you can get the things you need now and pay for them later. This helps you manage your money effectively, especially for big or unexpected expenses.

- Interest-Free Short-Term Finance: Some MobiKwik Zip plans offer interest-free financing for a certain period. With a limit of up to ₹60,000, MobiKwik Zip provides people easy access to credit without much documentation or a strong credit profile.

- Unparalleled Convenience: MobiKwik Zip is seamlessly integrated into the MobiKwik app, making it easy to manage your account, track spending, and make repayments directly within the app. The MobiKwik app allows you to make utility bill payments, recharges, etc., for which you can use your MobiKwik Zip pay later balance without remembering PINs or waiting for OTPs.

- Potential Credit Score Improvement: Using MobiKwik Zip responsibly by making timely payments and staying within credit limits can positively impact your credit score. BNPL services are among the best ways to build credit score from scratch.

However, there are some challenges to consider too. Following are some of the cons of MobiKwik Zip which may persuade you to close MobiKwik Zip service:

- Hidden Fees: Some plans may have processing fees or late payment charges, so it’s important to read the terms and conditions to avoid unexpected costs. There also is an activation charge (ranging from Rs. 99 to Rs. 399, which is refundable). MobiKwik also tries to automatically use Zip when your MobiKwik balance is low, which may lead to unintended spending.

- Overspending Temptation: The delayed payment feature might lead to impulsive spending. Being disciplined and financially aware is crucial to avoid overspending and accumulating debt.

- Personal Loan On Credit Report: MobiKwik Zip Pay Later service is reported as a personal loan to credit bureaus. If you don’t actively use the BNPL service, it is advisable to close MobiKwik Zip account, as too many small loan accounts may impact the credit profile and score negatively.

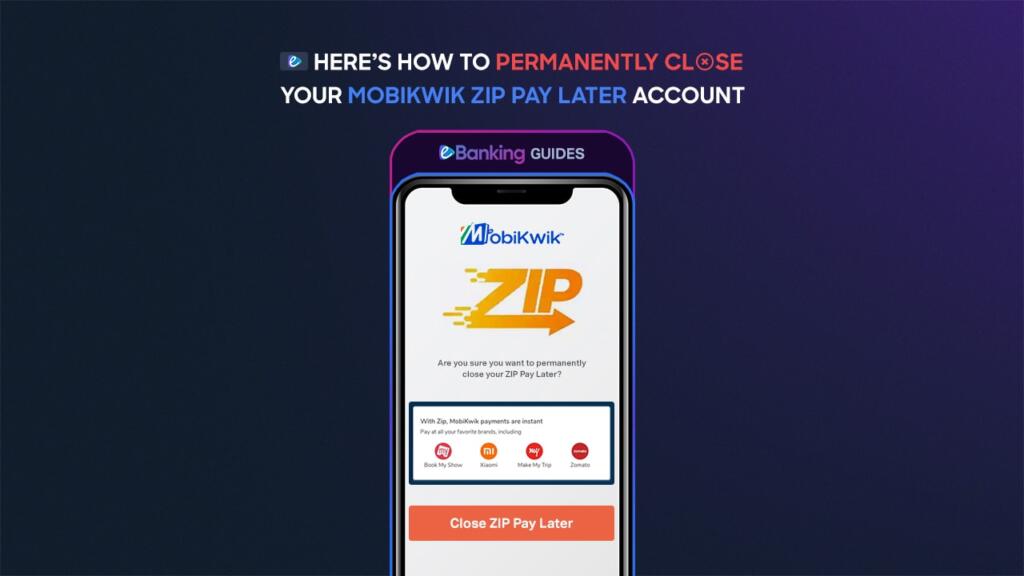

Close MobiKwik Zip Account

Follow the below steps to deactivate or close your MobiKwik Zip account:

- Update your MobiKwik app to the latest version.

- Open the app and navigate to your profile page by clicking on your profile picture at the top left corner, then go inside the “MobiKwik Zip” section. This will open the “Zip Dashboard” page. You can also tap the “Zip” icon directly on your MobiKwik app’s homepage to get to this page.

- On the “Zip Dashboard” page, ensure that there are “Auto Zip” is disabled, and that there are no pending dues. If there are any dues and your Zip statement is not generated, you can clear the dues by tapping on the “Pay in Advance” button on this page. Clear your dues, if any.

- Scroll down to the end of the “Zip Dashboard” page and take note of the lending partner that has sanctioned your Zip Pay Later credit. It should be mentioned at the end of the page. The most common ones are IDFC FIRST Bank and Lendbox, but be sure to take note of your particular lender from the page.

- Next, towards the bottom of the page, tap on the “Need help? Chat with us” option. This will open a support page where you can chat with MobiKwik support.

- Select “How can I close my Zip services” from the list of questions, or type and send it.

- In the next response, select “I want to close my Zip account”, or type and send it.

- Next, you will be asked for the reason for closure. Respond with a reason, like “I don’t use it often”, or “I have a very low credit limit”, or something along those lines.

- After you respond with the reason, a ticket will be generated for the MobiKwik Zip account closure. After that, the MobiKwik team will respond to the ticket within the next 24 hours, in which they will either ask for reconfirmation or acknowledge that your MobiKwik Zip account has been closed. If they ask for reconfirmation, you must confirm that you wish to close your Zip account.

That is it. After this, your MobiKwik Zip account will be closed within a few days, and you shall receive a no-dues certificate or a loan closure certificate from your lender. Remember the lending partner at the end of the “Zip Dashboard” page? They will be responsible for sending you these documents, so make sure you take note of them and contact them in case you don’t receive these certificates within a month of you closing your MobiKwik Zip account.

Alternatively, if you can’t use the app or can’t follow these steps for any reason, you can also contact MobiKwik directly and request them to close MobiKwik Zip account for you.

Important things to keep in mind

If you’re considering permanently closing MobiKwik Zip BNPL service, here are some important points to keep in mind:

- Obtain a No-Dues Certificate: After MobiKwik confirms the closure of your Zip account, obtain the No-Dues Certificate or No-Objection Certificate from the relevant lender without fail. This document is crucial and should not be overlooked.

- Allow Time for Credit Report Update: It may take up to 3 months for the closure of your MobiKwik Zip account to be reflected in your credit report. Be patient during this period and avoid unnecessary panic.

- Closed Status on Credit Report: Even after closing MobiKwik Zip, the entry may still appear on your credit report for a few years. However, it will be marked as ‘Closed’ instead of ‘Active.’

- Temporary Credit Score Dip: Closing your MobiKwik Zip may temporarily drop your credit score. This is normal, and your credit score will recover over time.

- Consider Keeping the Account Open for Credit Building: If you’re not actively using the Buy Now, Pay Later (BNPL) service but are new to credit and aiming to build your credit score, it’s advisable not to close MobiKwik Zip account. Keeping the account active and idle contributes to the age of your credit accounts and enhances your credit profile and score.

Frequently Asked Questions

Still on the edge regarding whether or not to close MobiKwik Zip account, or still have any questions regarding it? Below are some of the most frequently asked questions, answered.

-

What is MobiKwik Zip?

MobiKwik ZIP is a Buy Now, Pay Later (BNPL) service offered by MobiKwik. It allows users to make purchases on MobiKwik and partner retailers and pay for them later, typically within a set timeframe, often with no interest charges.

-

Why should I close MobiKwik Zip?

MobiKwik Zip has some issues – like limited acceptability, a low credit period (30 days max), hidden fees, and more, which might persuade you to close it.

-

How to close MobiKwik Zip Account?

You can close your MobiKwik Zip account through the in-app support options or by contacting MobiKwik via email or phone support. We have laid out all the steps in detail in our guide.

-

Does MobiKwik Zip affect CIBIL credit score?

Yes, since MobiKwik is reported to credit bureaus as a personal loan, it does have an impact on your credit score. Failure to pay dues on time may lead to a negative impact on credit score, while using it responsibly will positively impact the credit profile.

That will be all for this one. We hope this guide helps you to close your MobiKwik Zip Pay Later service. You might want to explore other Buy Now, Pay Later services in India to find the one that suits your financial needs better than MobiKwik Zip. Feel free to use the comments section to let us know if you still have any queries and we’ll try to help.

6 Responses

Closed my zip account.

mobikwik zip pay later

mene zip ka setalamend kya woske bat b mujhe call arhi hai mere cibil pr afat prdraha hai please close krwaye mujhe majburan canuni krowai krni prdgi…….

Sr Mera trasactree technologies private limited loan kaise pay kaise please payment link send kre

A/c no

redactedShort term personal loan

Ese close krne me meri help kre please

Hi Kesheo, aapko Transactree ko contact karna hoga. Email (support@lendbox.in) aur phone (+917291029298) par aap unki support team se baat kar sakte hain.

Sir I am unable to pay bills on mobikwik, everytime money deducted but payment fails. What to do?

Hey Pratik, that sounds like some technical issue with Mobikwik or your account. Please contact Mobikwik support.