Freecharge’s Buy Now Pay Later offering – Freecharge Pay Later has gotten quite some traction over the past couple of years. The credit for Freecharge Pay Later is sanctioned by Freecharge’s parent company and one of India’s biggest banks – Axis Bank.

Table of Contents

We shall go through the pros and cons of Freecharge Pay Later in this post and guide you open and activate your pay later account. Please go through all the pros and cons before signing up.

About Freecharge Pay Later

Freecharge Pay Later is a Buy Now Pay Later (BNPL) credit service offered by Freecharge to its users. When you sign up for this pay later offering, a credit facility of up to ₹10,000 is provided by Axis Bank. You can use your pay later balance to pay for transactions on the Freecharge platform, like for mobile recharges, utility bill payments, etc., and on merchants that support Freecharge Pay Later (like OnePlus and Swiggy).

As this is a consumer BNPL product, Axis Bank opens a personal loan account in the borrower’s name and loads the credit into that account.

Freecharge Pay Later Pros

The BNPL offering from Freecharge comes with some attractive benefits, which we’ve listed below:

- A credit limit of up to ₹10,000 allows you to do transactions on Freecharge and supported merchants in a jiffy when you’re running short of money, or when your banks are facing outages.

- No processing fees for activating and using the pay later service. Extra interest is charged for the amount you transact; a cashback equivalent to the interest you pay is credited to your Freecharge wallet after you pay your Freecharge Pay Later dues.

- One-tap checkouts when you use Freecharge Pay Later. You don’t have to enter any passwords or OTPs. As long as you’re logged into Freecharge (or have linked your Freecharge account on supported merchants), you have to tap one button.

- Occasional discounts and deals across Freecharge and Freecharge Pay Later partners and third-party merchants on transacting with Freecharge Pay Later.

- Good credit instrument to build your credit score from zero. Since there are no maintenance charges, you can activate and keep it idle for a while to build your credit score from scratch, in case you are new to credit.

How To Activate Freecharge Pay Later?

On to the juicy stuff. Here’s how you can sign up and start using Freecharge Pay Later:

- Open the Freecharge app on your device, or visit the Freecharge website and log in with your Freecharge account.

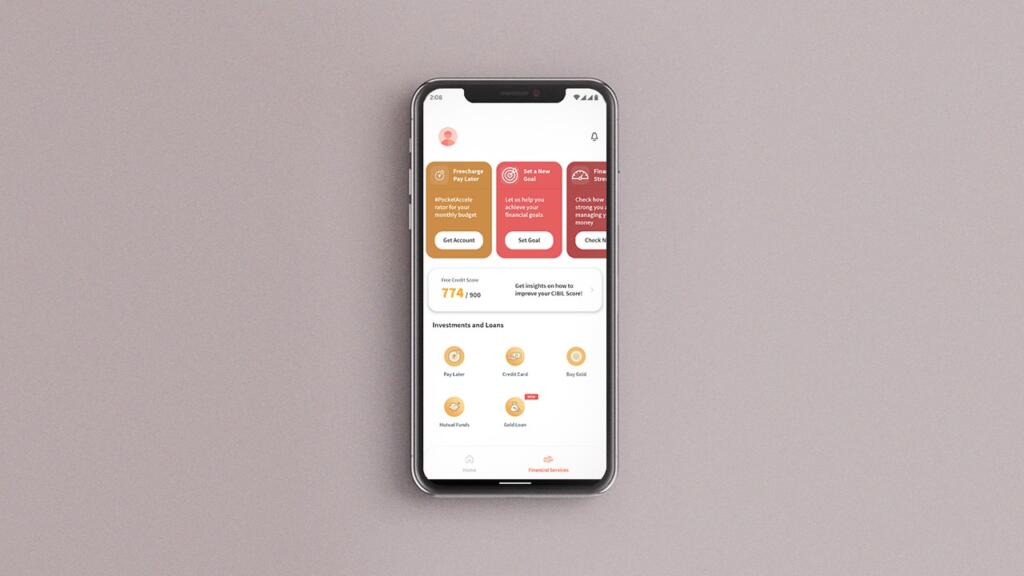

- Locate the ‘Pay Later’ icon or banner, which is typically placed in a “Financial Services” section or page on the app and website.

- Tap the ‘Apply Now’ button.

- On the page that follows, fill out the form with your details, and then tap the ‘Submit’ button to proceed to the next page for eKYC.

- Enter the OTP sent to your mobile number linked with your Aadhaar account on the next page, and click ‘Submit’.

That’s it. Freecharge shall then take a couple of minutes to submit your details and activate your Freecharge Pay Later account. You shall be able to use your pay later balance immediately after your account is activated.

Important: After your Freecharge Pay Later account is activated, remember to do a transaction within 30 days. If no transactions are done with Pay Later within 30 days of the account being activated, your Pay Later account can automatically be deactivated.

Please note that Freecharge Pay Later is currently not available to everyone. It is only available for select eligible users. If you don’t see the Pay Later option in your Freecharge app, you are currently ineligible. In such a case, you should wait for the option to be visible in your app. Freecharge is rolling out the pay later facility to more users every day, so keep using the Freecharge app and wait for your turn.

Freecharge Pay Later Cons

It’s not all bright and colourful, though. Freecharge’s pay-later facility does have some drawbacks that you should be well aware of before you activate and start using it. Following are some cons of Freecharge Pay Later:

- Lower credit limit than other BNPL offerings in the market. The maximum credit limit you get would be ₹10,000 only. If you have other pay later services with higher limits (like Amazon Pay Later), you may want to stay away from adding another small personal loan to your credit portfolio.

- Interest is charged on the pay later credit used by you. Although Freecharge currently issues you a wallet cashback equivalent to the interest amount you pay, the cashback can’t be transferred to your bank account and can only be used on Freecharge and other merchants that support paying via Freecharge. Amazon Pay Later, in comparison, doesn’t charge any interest or convenience fees.

- A 30-day credit period is provided (From the 5th of the present month to the 4th of next month). This means that you have a maximum of 30 days to pay back your dues. This is lesser than other pay later services, which have around 35 days of credit period per cycle.

- You get less than a day to pay your dues after your bill is generated. Freecharge Pay Later bill generation date is the 5th of every month, and you have to pay your dues on the 5th of the month itself, before the end of the day. This is a major con, since if you miss the payment for some reason, your credit report will be affected as Axis Bank will report a late payment. Auto-debit isn’t available either (though Freecharge says it’s coming soon). Other pay later facilities typically give you 5-7 days to pay your dues after your bill is generated.

- Unbilled dues can’t be paid before bill generation, meaning you have to wait for the bill generation, and then you get that less-than-a-day window to pay your bills.

Other than these, Freecharge Pay Later gets reported to credit bureaus as a personal loan, like other BNPL facilities. This can be a good thing if you’re new to credit, or a bad thing if you have too many active personal loans.

You can also find a couple more minor drawbacks of Freecharge Pay Later in our guide to close Freecharge Pay Later account. You can go through that post if you wish to know those drawbacks or if you already have Freecharge Pay Later activated and now want to close it.

Frequently Asked Questions

Here are some quick questions and answers for your convenience:

-

What is Freecharge Pay Later?

Freecharge Pay Later is a Buy Now Pay Later (BNPL) credit facility provided by Freecharge and its lending partner Axis Bank. You can use Freecharge Pay Later to pay on Freecharge and other supported merchants and partners.

-

How does Freecharge Pay Later work?

You can use your Freecharge Pay Later balance to pay on Freecharge and other merchants that support it. You get up to 30 days to repay your pay later dues.

-

Is Freecharge Pay Later a loan?

Yes, your pay later balance is drawn from a personal loan provided by Axis Bank – Freecharge Pay Later’s lender. It is also reported to credit bureaus (like CIBIL) as a personal loan issued by Axis Bank.

-

Does Freecharge Pay Later affect credit score?

Yes, since it is reported to credit bureaus (like CIBIL), it does have an impact on your credit score. Please pay your dues on time to avoid your credit score and profile from being impacted negatively.

-

Can I transfer Freecharge Pay Later balance to my bank account?

Nope, you can not transfer your Freecharge’s Pay Later balance to your bank account. You can only use it to transact on Freecharge and other supported partners and merchants.

That’ll be all for this one. Feel free to drop anything you want us to know or answer in the comments section below.