Joining the league of cashback credit cards, SBI has unveiled the brand new Cashback SBI Card. Similar to Axis Ace and ICICI Amazon Pay credit cards, the Cashback SBI credit card entitles users to get a flat 5% statement cashback on all online spending. Ofcourse, conditions apply. We’ll get into all the nitty-gritty of the brand-new SBI Cashback credit card and find out if it is any good for you.

Table of Contents

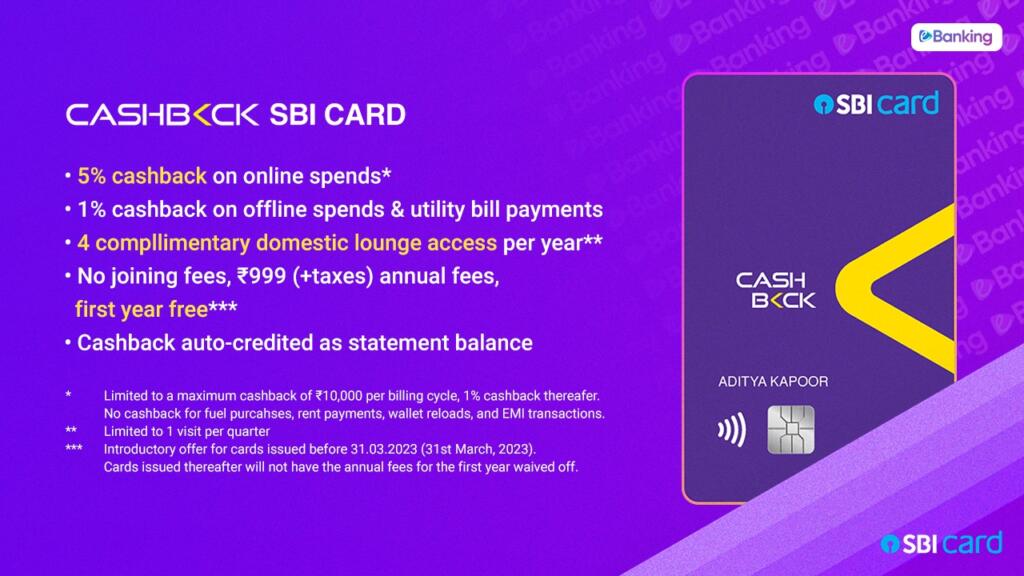

Before we jump into the core stuff, though, I wanted to pause a bit and appreciate SBI for the clean design they’ve implemented on this card. I like clean, minimal cards, and SBI credit cards have been nothing but the opposite of it. This one looks clean and modern. Additional points for getting it oriented vertically 🤩

The card benefits & features of the Cashback SBI Card have been revised after the publication of this article. The information contained on this page might be outdated; kindly check SBI Cashback Credit Card Devaluation for details.

Cashback SBI Card Benefits & Features

Going on a different route from their existing line of reward-based credit cards, the Cashback SBI card switches to a 1:1 direct cashback system, which is both simpler and uncomplicated for new credit card users than the reward-point system. Pretty much like Axis bank’s cashback cards, the cashback earned on transactions done with this card will be redeemed straight to the statement balance. You can then proceed to utilize this cashback for future spending.

Following is the cashback system and benefits of the SBI Cashback credit card:

- 5% cashback on online spends: Limited to a maximum cashback of ₹10,000 per billing cycle (5% cashback only on spends of the first ₹2 Lacs), thereafter 1% unlimited cashback. Cashback is earned only if the transaction value is more than ₹100.

- 1% cashback on offline spends & utility bill payments. Cashback is earned only if the transaction value is more than ₹100. Also, while digging through the detailed documentation of the card, insurance premium payments and payments for government services will get you 1% cashback.

- No cashback on fuel purchases, rent payments, e-wallet reloads, and EMI transactions.

- 1% fuel surcharge waiver: Transactions need to be between ₹500-₹3000, maximum waiver of ₹100 per billing cycle.

- Cashback auto-credited to card after generation of next month’s statement: Cashback you earn in the current billing cycle (let’s say 15 Aug – 15 Sep) shall be credited to the card two days after your next statement generation (in October).

- 4 complimentary domestic lounge access (1 per quarter) with Visa’s lounge program.

Cashback SBI Card Fees & Charges

Following are the fees and charges of the Cashback SBI credit card:

- Joining fee: Nil

- Annual fee: ₹999+taxes (about ₹1,179). For cards issued before 31.03.2023, the annual fee is waived off for the first year and shall only apply from the second year.

- Add-on card fee: Nil

- Annual fee reversal: Annual renewal fees will be reversed if spending in the previous year is more than ₹2 lacs.

Cashback SBI Card Eligibility & Application

As of now, SBI hasn’t disclosed the exact eligibility criteria for the Cashback SBI Card, so the approval or rejection of your application for this card depends on SBICard’s internal, undisclosed eligibility checks. It seems like, though, that a mix of a good credit score and genuine professional (employment) details shall deem one eligible for this card, like most of their other credit cards.

Some things to keep ready if you’re planning to apply for the SBI Cashback card:

- A good credit score (CIBIL) with no defaults or write-offs.

- Income and employment details and proofs (salary slips, bank statement, ITR, etc.).

- If you got an SBI credit card recently or closed one recently, you have to wait for 90 days (3 months) from the date of approval or closure to apply for this card online.

- If your SBI credit card application was declined recently, you have to wait for 180 days (6 months) from the date the application was declined to apply for this card online.

- Correct residence and office addresses as SBI conducts residence and office address verification and offline doorstep biometric KYC.

- The minimum age limit for SBI credit cards is 21 years.

You can apply for the Cashback SBI Card via SBICard’s website (Sprint). Offline application (both via branch and agents) isn’t available as of now but is expected to soon.

Cashback SBI Card vs. The Competition

How the card is positioned, the Cashback SBI Card locks horns with the likes of Axis Ace, Axis Flipkart, Axis Freecharge, Axis Airtel, ICICI Amazon Pay, RBL Zomato Edition, and Citi Cash Back credit cards. Its biggest pro is the flat 5% cashback on all online transactions, albeit being limited to ₹10,000 per billing cycle.

Unlike some other competing cards (ICICI Amazon Pay, RBL Zomato Edition), where the cashback is credited only in the form of store credits (or wallet balance), the cashback on the Cashback SBI Card gets credited straight onto the card, which can then be used anywhere. This is similar to Axis’s cashback redemption system, which is better than getting cashback in the form of store credits or wallet balances.

Apart from these, the Cashback SBI card is not co-branded, which means the 5% cashback on online spending isn’t limited to a specific merchant/brand. Plus, it shall continue to work for merchant-side bank offers on SBI credit cards. This makes the card very lucrative 💯

Final Thoughts & Review

Currently, this card seems like a no-brainer, and everyone should have one in their wallet, primarily if they transact online. It wouldn’t be wrong to say it overtakes almost all other co-branded cashback cards in terms of cashback. However, there are specific temporary issues that I feel you should be aware of as well:

- The application process for this card is online-only for now, but it has issues. If you’re applying as a salaried individual, the application page gets stuck after you fill in your office address and/or on the document upload page.

- Existing SBI credit cards can not be upgraded/flipped to the Cashback SBI Card currently. This should be possible in theory, but I guess SBI will need some time to streamline the process of flipping cards to this new variant. Currently, the only way to get this card is to do a fresh application for it (which is online-only atm).

- Though the annual fee for the first year is supposed to be waived, for now, people are still being charged the annual fee in the first statement. UPDATE: the annual fee (plus taxes) is now automatically being reversed.

There is no clarity on which bracket insurance payments fall in. I’d guess they’d be in the 1% cashback group, but I’ll confirm this when I get the card.As confirmed from the card’s MITC document, Insurance premium payments will get you 1% cashback.

We hope these issues are ironed out asap so that users can make the most out of this card. I’ll keep this post updated with new/updated information as and when that comes in.

If the cashback on offline spending and utility bills were a bit more (around 2%), this would simply have been the one and only cashback card in my arsenal. Even if there were an upper cap for the cashback (instead of unlimited 1%), say, 2% cashback up to ₹1,000, it would still have made the card a killer proposition. For now, I’ll still keep my Axis Ace & Airtel cards for utility bills, alongside this new one for all online purchases.

The full review shall be up on the website towards the end of the year. I’m waiting for my card, it has been approved, and I’ll post the full review after I get the card and use it for a couple of months, but initial impressions are very positive on this one. Ofcourse, there are some drawbacks, like only 1% cashback on offline spends, but they can be easily overlooked if SBI continues to honor the 5% cashback on all merchants online (except restricted categories). Looking at you, RBL Zomato Edition 😑

Frequently Asked Questions

Below, we’ve answered some of the most frequently asked questions about the SBI Cashback credit card.

-

Which SBI credit card is best for cashback?

The newly launched Cashback SBI Card is the best SBI credit card for direct cashback. The card gets you 5% cashback on online spends and 1% unlimited cashback on offline spends and select categories. The overall average cashback percentage for the card comes to around 2.5%, which is among the highest cashback rates for credit cards.

-

What is the eligibility for SBI Cashback credit card?

You need to have a good credit profile and a source of regular income to apply for the Cashback SBI card. The minimum age limit to apply for this card is 21 years.

-

How to apply for the Cashback SBI credit card?

You can apply for the new Cashback SBI card online on SBICard’s website. Offline application (via visiting branch or via agents) isn’t available at launch but is expected to be available in a few weeks.

-

What are the fees and charges on the Cashback SBI card?

There is no joining fee for the Cashback SBI card. There is an annual fee of ₹999 plus taxes (about ₹1179) which is waived off for the first year, and shall be charged from the second year onwards. The annual fee is reversed if spending in the past year exceeds ₹2 lakhs.

-

Can I upgrade my existing SBI credit card to the Cashback SBI Card?

As of now, no. The only way to get this card presently is to apply for it on SBICard’s website.

If you have any more questions or doubts, please feel free to leave them in the comments.