Credit bureaus in India, or anywhere, are primarily responsible for recording and analyzing borrowings, loans, and utilization of various credit instruments by individuals and businesses. Let us use this post to explain everything about credit bureaus, credit scores, how these work, and more.

Table of Contents

Credit Bureaus

Credit bureaus, credit rating agencies, or credit reporting agencies collect and analyze data related to an individual or a business body’s transactions made on credit (loans, credit cards, overdrafts, etc.). The information also includes personal details like address and contact numbers, alongside financial details like the number of loans taken, date and amount of repayments, etc.

Banks, lending bodies, and other financial data collection bodies report all this data to credit bureaus. Credit bureaus then analyze all this data to create a credit profile of a person or business, and this credit profile with all the historical information is used to decide their creditworthiness – the extent to which lenders will be willing to lend them financial credit.

If you’re interested, here’s a list of operative credit bureaus in India.

Credit Score

A credit score is a numerical representation of one’s creditworthiness. It generally varies in the range of 300 to 900 in India. A high credit score means more chances of getting credit, like loans and credit cards, and a low score means – you guessed it – fewer chances of getting loans and credit cards. A good credit score also ensures you get higher credit limits and low rates of interest on credit facilities, and a low credit score means lenders charge you more interest and sanction lower credit limits.

In India, a credit score of more than 700 is considered good, and anything below 500 is considered below average. Don’t know what your credit score is? Well, we’ve got a nifty little guide to help you check your credit score for free. You’re welcome.

But, but, but, since there are multiple credit bureaus in India, and all of them have adopted different methods of deriving your creditworthiness and calculating your credit score, your credit score will most likely vary across all these various bureaus. On one, you might have a score of 800, while on the other, it would be around 700. That’s perfectly normal; no need to worry. What is important is that you should aim for the green range, which is above 700, across all these bureaus. Oh, and did we mention we also have a guide to help you build credit score from zero?

Credit Inquiry

A credit inquiry, or a credit check, is a request made by a lender or credit institution to retrieve one’s credit report info from a credit bureau. Credit inquiries can be made for a variety of reasons, from checking how many loans and credit cards you have, to whether or not you are eligible for a new credit card. Credit inquiries are classified into two types: Hard Inquiry, and Soft Inquiry.

Hard Inquiry vs. Soft Inquiry

Hard inquiries (also known as ‘hard pulls’ or ‘hard checks’) are initiated by a financial institution when they wish to assess one’s creditworthiness for a new line of credit or a major credit instrument. When an institution makes a hard inquiry, the credit bureau provides the complete credit report of the assessed alongside the credit score. To perform a hard inquiry, the lender or financial institution has to take explicit consent from the customer. Hard inquiries are visible in all credit reports under a “Credit Inquiry” or “Credit Check” section.

Hard inquiries can have a noticeable impact on one’s credit score. These checks typically result in a temporary drop in the credit score by a few points. Therefore, it isn’t recommended to apply for a lot of credit instruments in a short span, to avoid the credit score from falling drastically.

Soft inquiries, on the other hand, are primarily done in cases where a deeper assessment of one’s credit profile isn’t required, e.g., checking whether a customer is eligible for an increase in their existing credit card limit, or a user refreshing their credit report through an app. Soft checks might not be visible on your credit report, but when they are, the inquiry amount is typically very less, like ₹500 or ₹1000.

Soft inquiries do not affect one’s credit score, and financial institutions don’t have to take explicit permission before every soft inquiry. Some banks even have automated soft-inquiry schedules in place to keep track of their customers’ credit scores so that they can offer them preapproved products and services.

How do Credit Inquiries work?

When you apply for a line of credit, like a personal loan, the lender or financial institution (bank) wants to make sure you can repay the loan. These financial institutions also have a certain threshold below which they consider someone to be highly risky to lend money to, and thus consider borrowers under that threshold ineligible for lending money to. To back all of these operations, they depend on credit bureaus.

Banks ping credit bureaus with credit inquiries to get access to your details, credit history and present, credit score calculated by the bureau, and more. Your credit score is typically the first filter. If the lender has set a minimum credit score that they consider for loans, all applicants below that set score are declined. If they fall above this number, then the lenders review their credit profile and make a call on whether or not to proceed with the application.

Keep in mind that hard inquiries give credit bureaus your complete credit report, including any late payment records and non-payment entries. Therefore, it is always recommended to keep your credit profile clean and healthy.

Some bureaus also have a risk score calculator algorithm, that, based on your credit profile, generates a risk score and gives it to the lender upon inquiry of a certain amount. Simply put, support a bank does an inquiry of ₹75,000 for a Credit Card on Arun’s credit profile. The bureau then tells the bank that the risk score for this amount of Arun is 10 – which is highly risky. If the score were somewhere around 5, the bank would then have manually reviewed the complete profile, but since the risk score is very high, they can easily filter Arun out (kinda feeling sorry for Arun, he ain’t getting this credit card).

This risk score therefore can also be a determining factor for your credit eligibility.

Credit Utilization

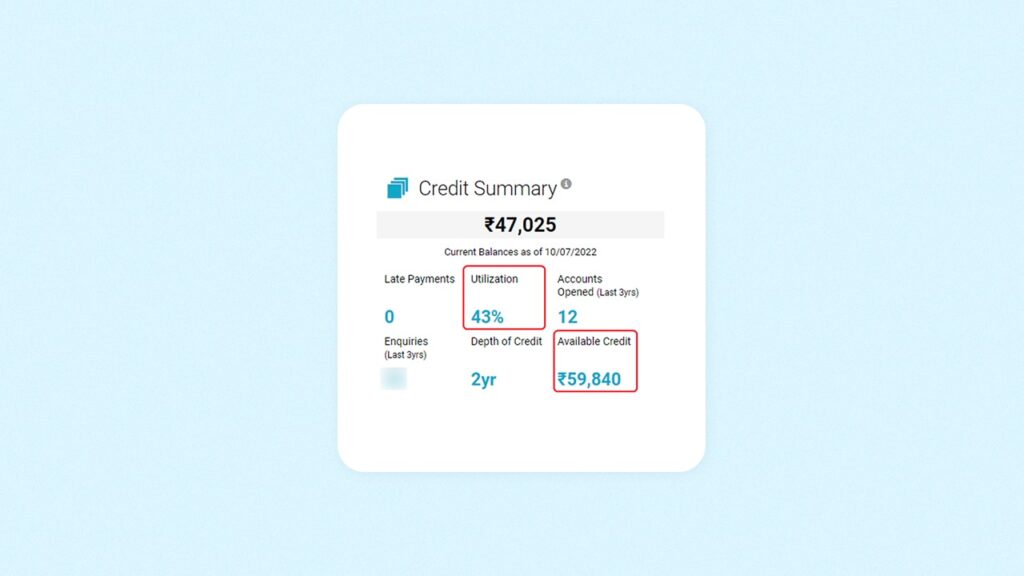

Credit utilization refers to the amount of credit one has used compared to the total amount of credit sanctioned. Across the most common credit bureaus, credit utilization is presented as a percentage.

Credit utilization is an essential factor in deciding one’s creditworthiness and credit score. A higher credit utilization might make one seem credit-hungry, which is a negative quality of one’s creditworthiness. On the flip side, having a high credit utilization might hint credit card issuers to increase your credit limit. But generally, having a credit utilization of around or under 50% is considered healthy. Keeping the credit utilization under 50% has resulted in an overall improvement in the credit score in the long term.

Frequently Asked Questions

Still got questions? Good, because we’ve got short and sweet answers!

-

What is a Credit Bureau?

A Credit Bureau is an institution that collects and analyzes data related to people’s and businesses’ credit facilities, like loans, credit cards, etc. This data is used by lenders and financial institutions to provide appropriate credit instruments.

-

What is a Credit Score?

Based on one’s credit profile, credit bureaus calculate a numerical score to indicate their creditworthiness. This score is called one’s credit score and generally falls in the range of 300 to 900.

-

How can I check my credit score?

You can check your credit score on a credit bureau’s website/app, and on third-party apps like Paytm as well. We have guides on our site to help you check your credit score for free, please read those.

-

What is a good credit score?

On a scale of 300 to 900, anything above 700 is considered a good credit score, and anything above 800 is considered excellent, in India. If your credit score falls between 500 and 700, you have an average credit score.

-

What is a bad/poor credit score?

Anything below 500 is considered a poor credit score, and it might render one ineligible for credit facilities from most financial institutions, or higher interest rates when eligible.

-

How do I boost my credit score?

You can boost your credit score by regularly paying your credit bills on time, having a mix of various credit instruments, and more. You can check our guide on How to Improve Credit Score to learn more ways in which you can boost your credit score.

-

What is a Credit Inquiry?

A credit inquiry or credit check is the process when financial institutions request credit bureaus to provide credit reports of a borrower so that they can analyze the same and offer appropriate credit facilities to them.

-

What is a hard inquiry in credit?

A hard inquiry is the type of credit inquiry financial institutions make when you apply for a new credit instrument (like a home loan). When a hard inquiry is made on your credit report, the credit bureau provides your complete credit report to the requester, including the data of all active credit facilities. Hard inquiries are always recorded in your credit report in a dedicated ‘Credit Inquiry’ section.

-

What is a soft inquiry in credit?

A soft inquiry is made when financial institutions don’t want your complete credit report, and just want your credit score and a few personal details. Soft inquiries are made to determine your eligibility for upgrades in existing credit instruments (like a credit limit increase on your current credit card), or for occasional offers and deals (like a quarterly milestone benefit).

-

How much credit should I utilize?

It is recommended to keep your overall credit utilization under 50% to keep your credit score from being impacted negatively. Using more credit would make you appear ‘credit-hungry’ in front of lenders.

Phew, this was a loooong post. Hope it helped. Feel free to engage in the comments section below if you have doubts or questions, or just let us know if this explainer was of some help to you.

2 Responses

How to check my credit score for CIBIL and Experian? I tried Paytm app but it doesn’t refresh my score after December 2022. Pls help.

Try Google Pay, Freecharge, Amazon (Amazon Pay), and OneScore apps to check your CIBIL score.